- Home

- Live Blog

- Breaking News

- Top Headlines

- Cities

- NE News

- Sentinel Media

- Sports

- Education

- Jobs

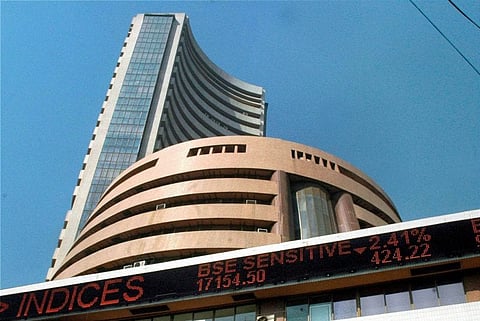

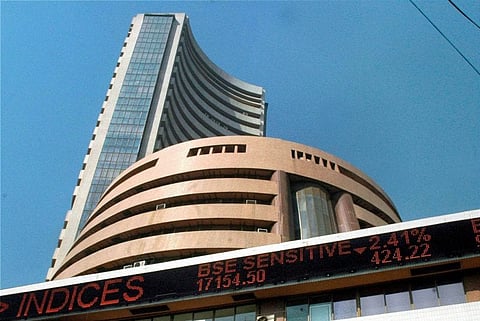

Mumbai: Fluctuation in crude oil prices coupled with the direction of foreign fund flows are likely to chart the course of major domestic equity indices next week. According to market observers, other factors such as rupee’s movement against the US dollar and expectations of measures from the Reserve Bank of India’s board meet to resolve the liquidity crisis will also influence investor sentiments. However, state elections-related anxiety could ignite volatility, they felt.

“Investors will continue to watch the movement of rupee, crude oil prices and foreign fund flows,” said SMC Investments & Advisors Chairman and Managing Director D.K. Aggarwal.

“Next week, Nifty is expected to trade between 10,500-10,900 points, while bank Nifty is expected to move in the range of 25,800-26,600 points.” Over the recent past, fears of a global slowdown and excess stockpile subdued the benchmark Brent crude price. It closed last week’s trade at $67.74 from $86 a barrel level which was touched in early October.

The fall in crude oil prices assumes significance as it eases India’s concerns over inflation, fiscal and current account deficit. The country is the third-largest importer of crude oil in the world.

Apart from crude oil prices, the direction of foreign fund flows will set the course of the key indices. Last week’s provisional investment figures from the stock exchanges showed that foreign institutional investors bought scrips worth Rs 3,502.46 crore which was 22 times more than the previous week.

Over the last month, uncertain domestic and global economic growth outlook, as well as a sharp decline in rupee value, had triggered a massive fund outflow. Another key area for investor’s interest will be the rupee’s price movement against the US dollar. Lately, lower crude oil prices and healthy macro-data have aided the rupee to recover.

On a weekly basis, the Indian rupee strengthened by 57 paise to 71.92 per US dollar from its previous week’s close of Rs 72.49 per greenback. “Market has largely factored a gradual downgrade in earnings in the second half of FY19,” said Vinod Nair, Head of Research at Geojit Financial Services.

“While investors are looking for major triggers for a decisive up move above 10,700 points level, stability in INR and oil prices will provide direction to the market despite election-led uncertainty.” On technical charts, NSE Nifty50’s northward trajectory will face resistance at 10,755 points level.

“Technically, Nifty seems to have resumed the northward movement this week after breaching the 10,645 points level,” said Deepak Jasani, Head of Retail Research for HDFC Securities.

“The next resistance for Nifty is at 10,755 points and 10,843 points, while 10,440 points could provide support.”

Last week, a slide in global crude oil prices, along with a healthy influx of foreign funds and a strengthened rupee buoyed the Indian equity market indices. Accordingly, the S&P BSE Sensex gained 298.61 points, or 0.8 per cent, to close at 35,457.16 points. Similarly, the 50-share Nifty of the National Stock Exchange (NSE) advanced 97 points, or 0.91 per cent, to settle at 10,682.20 points. (IANS)