- Home

- Live Blog

- Breaking News

- Top Headlines

- Cities

- NE News

- Sentinel Media

- Sports

- Education

- Jobs

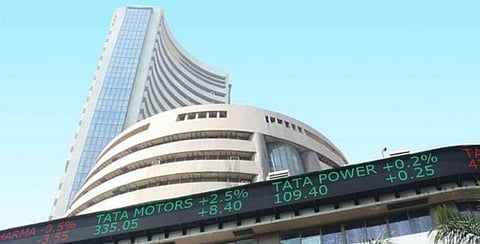

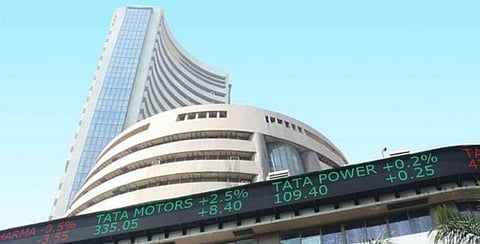

Mumbai: After the Indian markets witnessed one of its worst single-day falls on Friday, experts expect volatility to continue in the coming week.

Investors will have a keen eye on the purchasing managers’ index (PMI) and the auto sales numbers, to be released during the week. Persistent concerns in the global markets over coronavirus (Covid-19) and possibilities of it turning into a pandemic could weigh on the domestic markets too, analysts said.

The subdued gross domestic product (GDP) data for the October-December quarter, released on Friday, is also likely to make its mark on the markets this week. The slowdown continued to hamper India’s economic activity as the Q3FY20 GDP growth rate was 4.7 percent against the revised estimate of 5.1 percent reported for the previous quarter. As per the data, the revised Q2 GDP growth rate stood at 5.1 percent from the earlier 4.5 percent.

“The risk to the markets increases. The longer the infection lasts, the more widespread it gets. The numbers, regarding the spread of the disease, and how far it can be contained will drive the markets next week. Measures by the governments to boost respective economies will also be watched out for, after the Chinese government support to bolster the economy,” said Vinod Nair, Head of Research at Geojit Financial Services.

Nair said the slowdown in global economic growth might continue for some time until the virus was contained, and it might not happen very fast. But the recovery has to happen and investors would do well to be focused on the long-term potential of the markets, he added.

Siddhartha Khemka, Head of Retail Research at Motilal Oswal Financial Services, said, “Investors are fearful that it might lead to global recession as the outbreak is spreading to the world’s largest economy - the USA as well as Europe, which will adversely impact big time the global supply chains, including India, and derail economic growth.”

Continuous selling by foreign institutional investors also dented the sentiments, he added. “The markets will continue to remain volatile and weak till the spread of coronavirus is controlled,” Khemka said.

According to Navneet Munot, CIO of SBI Funds Management, the coronavirus shock may have acted as a trigger for the markets anyway, waiting for the correction.

“While it’s too early to estimate the exact impact, it’s likely that policy action will have to stay growth supportive. Yet as growth continues to struggle, even with all the monetary accommodation, it only suggests that monetary policy has hit its limits. It only reaffirms our belief that fiscal policy will have to play a major role going forward to take the global economy out of this prolonged slump,” Munot said.

Deepak Jasani of HDFC Securities said, “In the coming week, auto stocks will be in focus as auto companies will start announcing monthly sales numbers for February, starting on 1 March.”

The Markit Manufacturing PMI for February will be declared on Monday and Markit Services PMI on Wednesday.

Auto sales numbers for February, scheduled on Sunday and Monday, will be a major factor for the auto stocks. Maruti Suzuki India and Mahindra & Mahindra on Sunday announced sales numbers for last month, which came on the lower side.

On the technical front, Deepak Jasani said, 11,090 would be a major support for the Nifty50, else the current downtrend is likely to continue. The index would find resistance at 11,385-11,536, he said.

On Friday, the Nifty50 closed at 11,201.75, lower by 431.55 points or 3.71 percent from its previous close. The Sensex closed 1,448.37 points or 3.64 percent lower at 38,297.29 points. (IANS)