- Home

- Live Blog

- Breaking News

- Top Headlines

- Cities

- NE News

- Sentinel Media

- Sports

- Education

- Jobs

Athens: The Maldives is grappling with a mounting debt crisis that threatens its economic sovereignty, as foreign exchange reserves dwindle to precarious levels while substantial debt repayments loom.

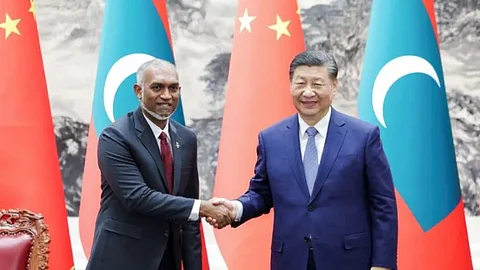

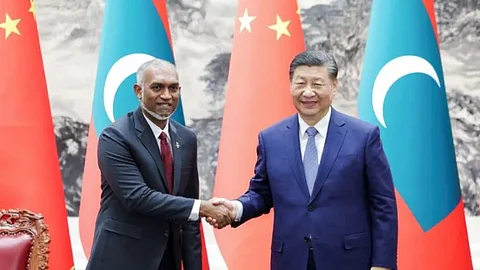

According to an article by human rights advocate and freelance journalist Dimitra Staikou on Medium, China’s lending practices and trade policies have significantly accelerated the island nation’s financial deterioration.

“The scale of the debt problem is staggering. The Maldives’ total debt stock has ballooned from USD 3 billion in 2018 to USD 8.2 billion as of March 2024, with projections indicating a further increase to more than USD 11 billion by 2029. Of the current debt, USD 3.4 billion is external, with China and India being the primary creditors,” Dimitra wrote. The immediate financial challenge is daunting, with the Maldives needing to service external debt worth USD 600 million in 2025 and a staggering USD 1 billion in 2026.

Usable foreign exchange reserves held by the Maldives Monetary Authority stood at below USD 65 million as of December 2024, an improvement from the alarming low of USD 21.97 million in July 2024. However, reserves briefly turned negative in mid-August, underscoring the severity of the balance of payments crisis.

In response, international financial institutions have downgraded the country’s credit rating. Fitch lowered the Maldives’ rating by three notches in consecutive cuts made in June and August, while Moody’s maintained a negative outlook for the government’s long-term local and foreign currency issuer rating.

Dimitra highlighted that the China-Maldives Free Trade Agreement (FTA), implemented in January 2025, has worsened the country’s economic vulnerabilities rather than providing relief. (ANI)

Also Read: Pope Francis’ health improves: Vatican

Also Watch: