- Home

- Live Blog

- Breaking News

- Top Headlines

- Cities

- NE News

- Sentinel Media

- Sports

- Education

- Jobs

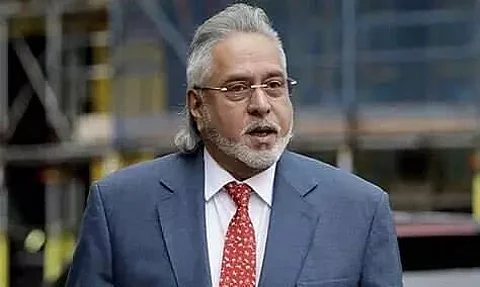

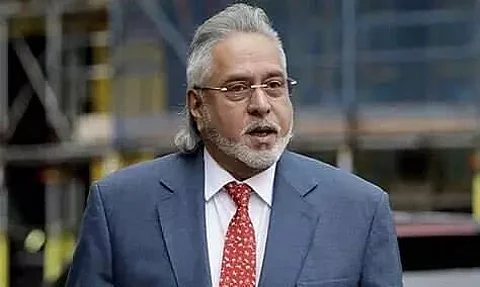

New Delhi: A United Kingdom court has ordered Vijay Mallya along with his entire family to be evicted from his plush London home on 18 January.

This court order is a huge setback for the fugitive economic offender who left India on March 2, 2016 and has been evading Indian authorities ever since.

Mallya, along with his wife Lalitha and son Siddharth, who currently resides in Cornwall Terrace apartment, which overlooks Regent's Park in London, will be evicted from the luxurious property.

It has been reported that Swiss Bank UBS will confiscate the 65 year old businessmen's prime property.

High court judge Deputy Master Matthew Marsh, while delivering his judgement virtually in the long running dispute, ruled that there were no grounds for him to give further time for the Mallya family to refund a 20.4-million pounds (about Rs 185.4 crore) loan to UBS.

The judge did not permit to appeal against his order or to grant a temporary stay of enforcement. The verdict signifies UBS can go with the possession process to recover its debt.

Rose Capital Ventures, a Mallya family owned trust which is based in the tax haven of British Virgin Islands, had mortgaged the London property to UBS as security for a five-year loan of 20.4 million pounds in 2012. The loan got expired in 2017 but Mallya did not clear out the outstanding dues to the bank.

Meanwhile, Union Finance Minister Nirmala Sitharaman had informed that lenders have recovered Rs 13,109.17 crore from asset sale of fugitives like Vijay Mallya, Nirav Modi and Mehul Choksi.

She also emphasized that the latest recovery was Rs 792 crore from the sale of assets belonging to former Kingfisher Airline boss and others on 16 July 2021.

The beleaguered businessman was declared as a fugitive economic offender (FEO) by a Mumbai Court in 2019 and he became the first businessmen to be declared an FEO under the Fugitive Economic Offenders Act.

Vijay Mallya had taken a loan of around Rs. 9,000 crore from a consortium of 13 public sector banks but failed to repay the amount.

The liqour baron is fighting an extradition battle with the British government to halt his imminent deportation to India over his failure to repay loans.

Also watch: