- Home

- Live Blog

- Breaking News

- Top Headlines

- Cities

- NE News

- Sentinel Media

- Sports

- Education

- Jobs

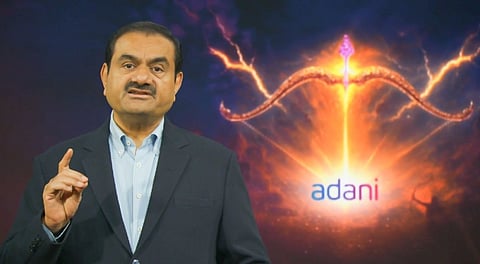

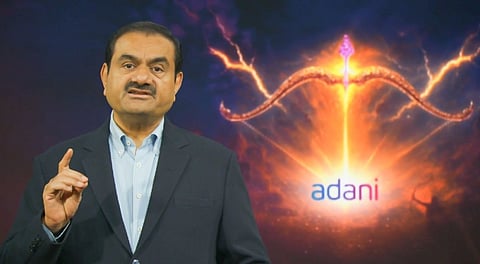

New Delhi: Adani Group Chairman Gautam Adani’s net worth surged by $13 billion in just two days, driven by a sharp rally in the group companies’ shares.

According to the Bloomberg Billionaires Index, Gautam Adani’s wealth now stands at $95.7 billion, placing him just behind Reliance Industries Chairman Mukesh Ambani, whose fortune has dipped to $98.6 billion.

So far this year, Gautam Adani’s net worth has grown by $17.1 billion, more than double the $8.02 billion increase recorded in Mukesh Ambani’s net worth.

The spike in Adani Group stocks follows a clean chit from the Securities and Exchange Board of India (SEBI) in the Hindenburg short-selling case.

In its final order, the market regulator dismissed allegations of fund routing and related-party transactions, confirming that the conglomerate had not violated any regulations.

Market confidence has been reflected strongly in stock prices. In the last three sessions, Adani Power has soared nearly 30 per cent, Adani Total Gas 18 per cent, Adani Green Energy 15 per cent, and Adani Energy Solutions over 10 per cent. Adani Enterprises has gained more than 11 per cent, while Adani Ports has risen nearly 3 per cent.

Earlier, the Adani Group Chairman had urged the Group staff to accelerate the pace of innovation and drive bold advances in energy, logistics, and other infrastructure that push the very edges of possibility, as the cloud of the Hindenburg case over the conglomerate has been lifted with the SEBI verdict rejecting the allegations of the US short-seller.

“We must build not for today’s applause but for a legacy that endures for decades. Headlines fade, but what we create must leave its mark on history,” Gautam Adani said in a letter to the Group’s staff.

“Today, a cloud that had hung over us for more than two years has been lifted. SEBI’s comprehensive investigation has concluded by rejecting all allegations contained in the Hindenburg report from January 2023,” the letter states. (IANS)

Also Read: ‘Indian IT firms to tackle H-1B visa fee hike with local hiring, offshoring and nearshoring’

Also Watch: