- Home

- Live Blog

- Breaking News

- Top Headlines

- Cities

- NE News

- Sentinel Media

- Sports

- Education

- Jobs

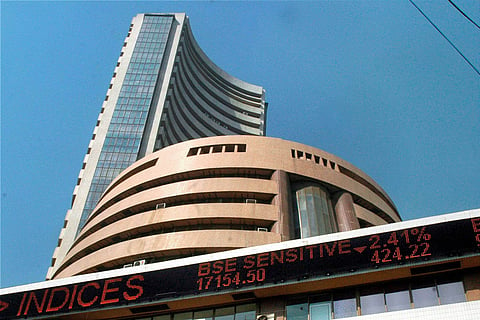

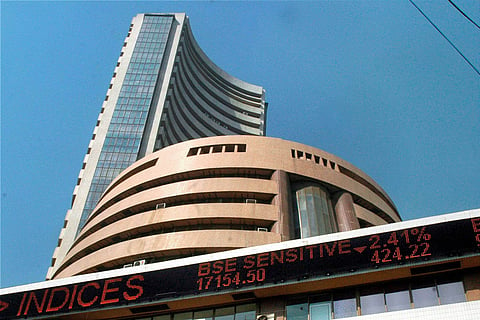

Mumbai, Jan 30: Mixed corporate earning results and caution ahead of the upcoming Interim Budget as well as the F&O expiry kept the indices from advancing on Wednesday as the Sensex and Nifty ended on a flat note.

Globally, major Asian markets closed on a mixed note while the European markets like CAC and FTSE traded in the green ahead of the US Fed meet outcome later in the day.

Banking, capital goods and metal stocks gained over 1 per cent while energy and telecom stocks ended in the red.

The BSE Sensex closed 1.25 points lower at 35,591.25, after it shuttled over 350 points, while the broader Nifty finished at 10,651.80, down 0.40 points.

“Risk for further downside in FY19 earnings due to mixed third quarter results and upcoming Interim Budget refrained investors” from taking fresh positions, said Vinod Nair, Head of Research, Geojit Financial Services.

“Market fluctuated between gains and losses and ended with marginal loss while global market was positive,” said Vinod Nair, Head of Research, Geojit Financial Services.

Nair also added that the risk for further downside in FY19 earnings due to mixed third quarter results and upcoming interim budget refrained investors from taking fresh positions.

“At the same time dichotomy was seen in 10 year yield which is softening currently in expectation of ease in monetary policy and is giving a ray of light to the market,” Nair said.

The rupee on Wednesday closed on a flat note at 71.12 per dollar from its previous close of 71.11.

“Technically, the Nifty is now trading in a narrow range after the recent sharp fall. Further directional cues are likely to emerge on a move beyond the 10,583-10,707 range,” said Deepak Jasani of HDFC Securities.

DHFL stock price continued to fall a day after a news website alleged that its promoters have siphoned off Rs 31,000 cr from the company.

“This was despite the company denying the allegations and stating that it has appointed an external agency to examine the complaint and ensure transparency,” said Jasani.

DHFL stocks ended Wednesday’s trading session declining close to 5 per cent after it tanked close to 10 per cent at one point.

The top gainers among the 30 stock Sensex were ICICI Bank and Tata Steel -- gaining over 5 per cent -- while Axis Bank, Bajaj Finance and HCL Tech gained in the range of 2 to 4.5 per cent.

Among the top laggards were Bajaj Auto, Kotak Mahindra Bank, HDFC, Yes Bank and ITC, which declined in a range of 1 to 3 per cent.

Investment-wise, both foreign institutional investors (FII) and domestic institutional investors (DII) were net buyers. FII bought shares to the tune of Rs 130.25 crore and DII bought Rs 502.26 crore worth of shares. (IANS)

Also Read: Business News